20th Shanghai International Fisheries and Seafood Exhibition

18th Shanghai International Aquaculture Exhibition

展会倒计时天

By Maria Feijoo

The Ecuadorian shrimp sector experienced an 'ideal situation' in August when production was exported more or less evenly to the country's three main import markets, consultant Gabriel Luna of GLuna Shrimp, said.

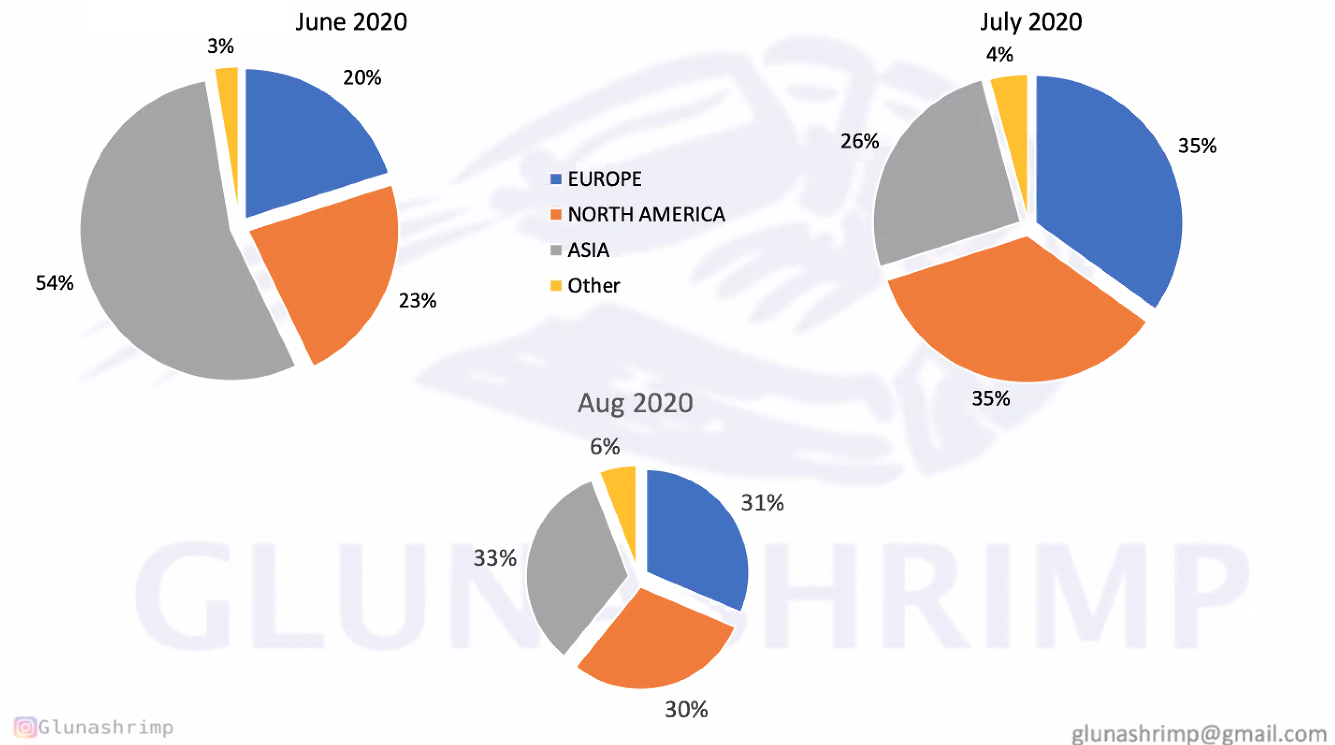

According to the data Luna presented on a webinar held by India's Society of Aquaculture Professionals on Sept. 24, Ecuador exported 33% of its production to China, 31% to Europe, and 30% to the US in the eighth month of this year.

"Ecuador has three main import markets for Ecuadorian shrimp [China, the EU and the US], so the most optimal situation would be to be able to divide the production and export it equally to those three markets," he explained. "What happened in August .

Moreover, Ecuador's monthly export data shows its intention to grow in Europe and the US, with exports of head-on, shell-on (HOSO) shrimp products and value-added products, respectively, he added.

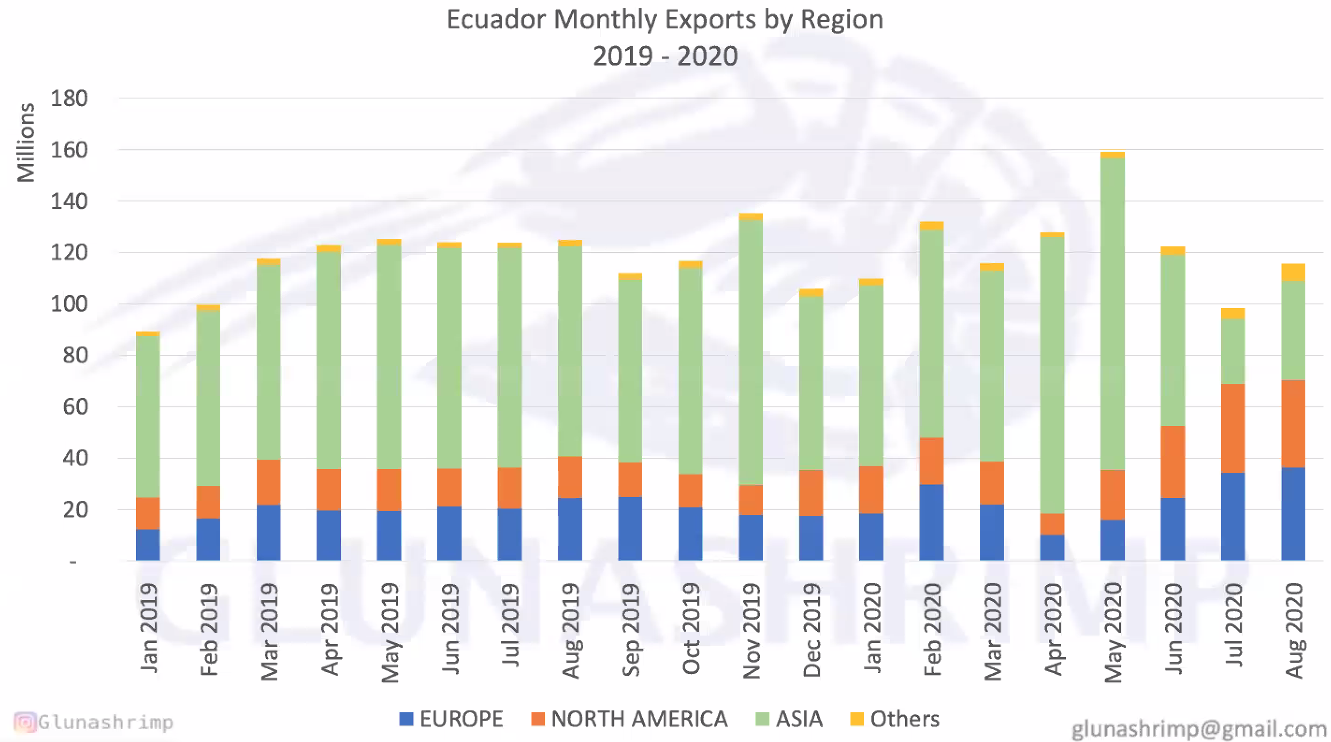

"During the first months of the year, we shifted our exports to the US and Europe, pushing a little more product to those markets to try and set off the lack of demand from China due to the pandemic outbreak there," he said.

Recently, Undercurrent News previously reported a fall in farmgate prices of between $0.20/kg and $0.80/kg for HOSO shrimp on Sep. 28, mainly due to a seasonal demand contraction that follows the end of summer.

New shift in Ecuadorian shrimp exports

The shrimp market changed a lot in recent months due to a decline in exports to the US from India, which allowed Ecuador to step up and cover the US' needs, Luna said.

"Geographically, we are very close to the US, so our products take only around three weeks to reach the country," Luna said.

"In June, exports to the US increased to 28 million pounds [14,000 metric tons], but it was in July when we reached our highest ever export to this country with 35m pounds, doubling what we usually do in mid-summer."

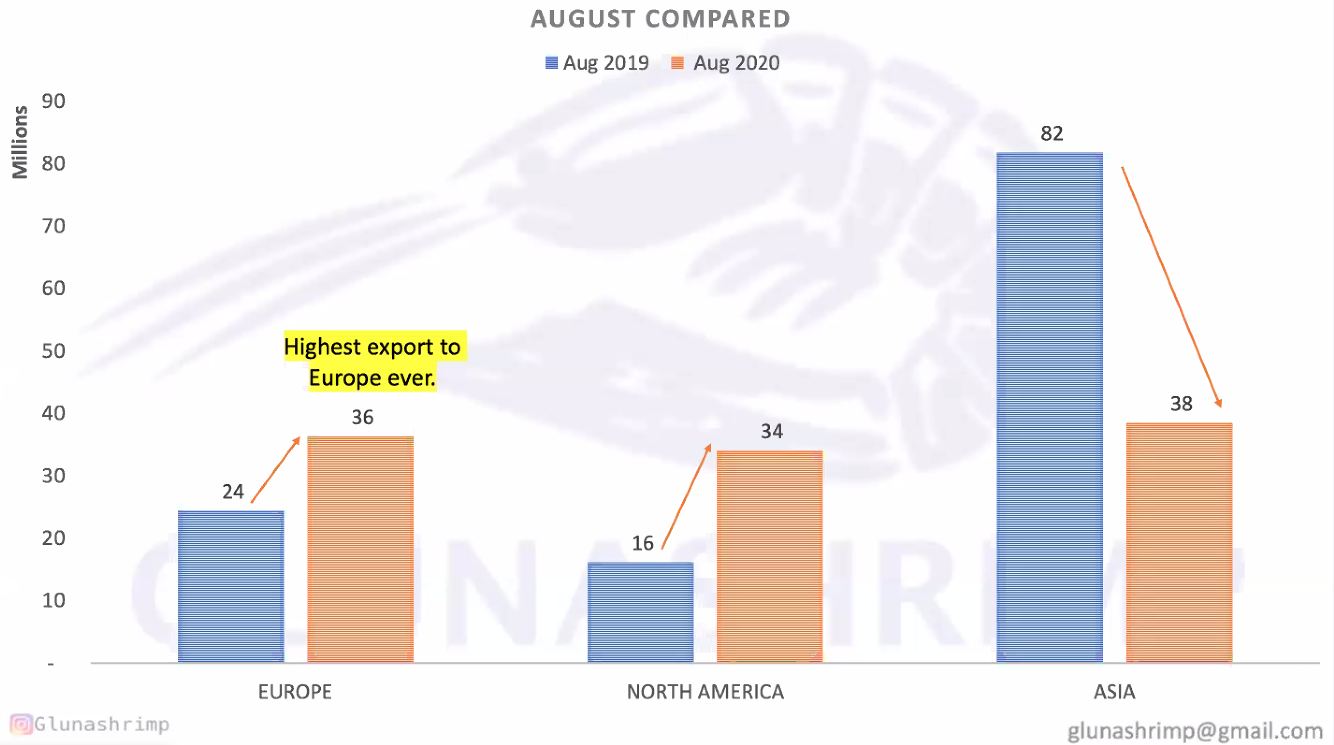

Additionally, Ecuador exported some 36m pounds of shrimp to Europe in August, which is the country's higher ever export volume of shrimp to Europe so far, according to Luna.

Also, low levels of exports to China in July and August due to the suspension of exports from three of Ecuador's largest shrimp companies on July 10 have been the trigger for the Latin American country to expand its market share in the EU and the US, he added.

As the data below shows, China has been the largest importer of Ecuadorian shrimp since 2014. However, the sector had to target its export markets differently not only due to these restrictions and the fear of exporting to the Asian giant derived from the situation.

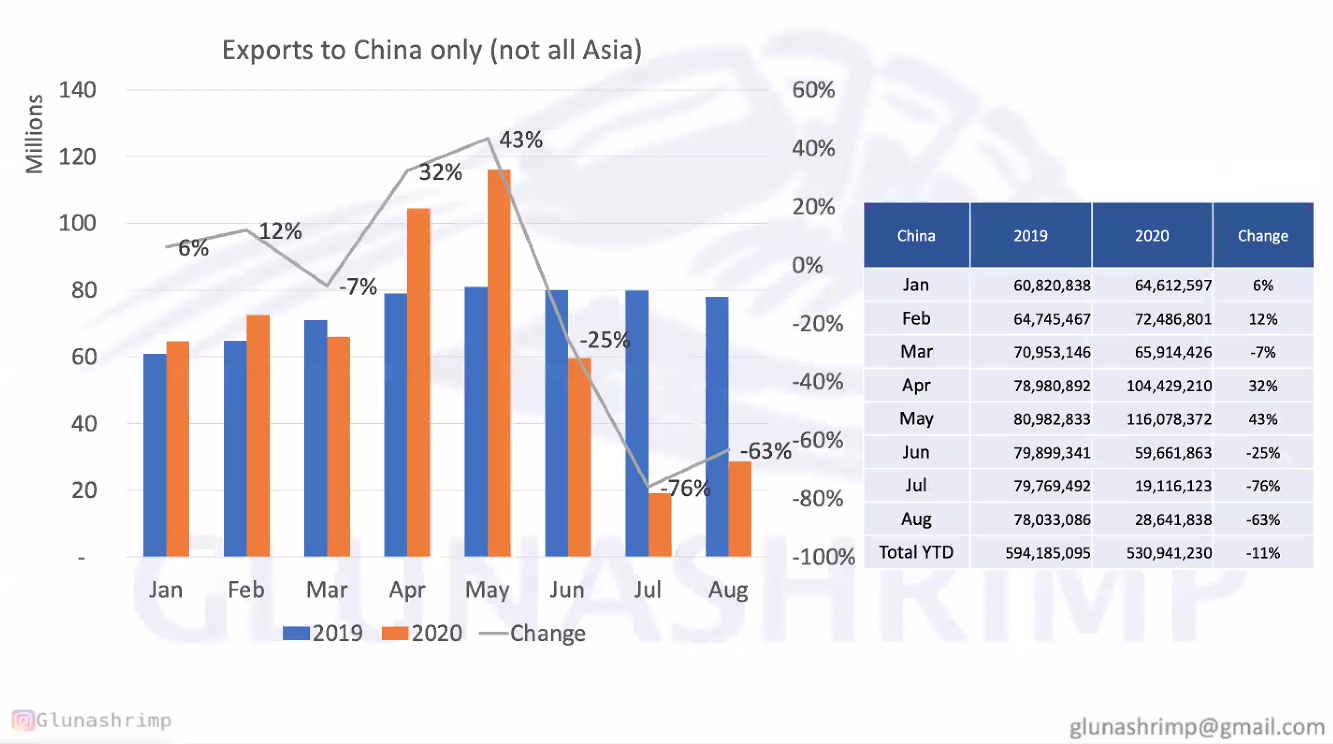

"We are doing a lot of effort in trying to send to China only what they are demanding, as we believe they probably still have stock in their warehouses from previous months," Luna said.

"Year-to-date, exports to China are down 11%, and, as soon as we stopped exporting to China at the same levels we were used to, shrimp prices bounced up in Ecuador," he explained.

"And of course we still have product, but we are shipping it to Europe and the US too now. If China wants it, it will have to pay a better price for it."

Exports to China fell for the first time this summer in June, showing a drop of 25% year-on-year. However, the sharpest falls took place in July and August, where exports dropped by 76% and 63% y-o-y to 19m and 29m pounds.

Exports to grow little due to COVID-19

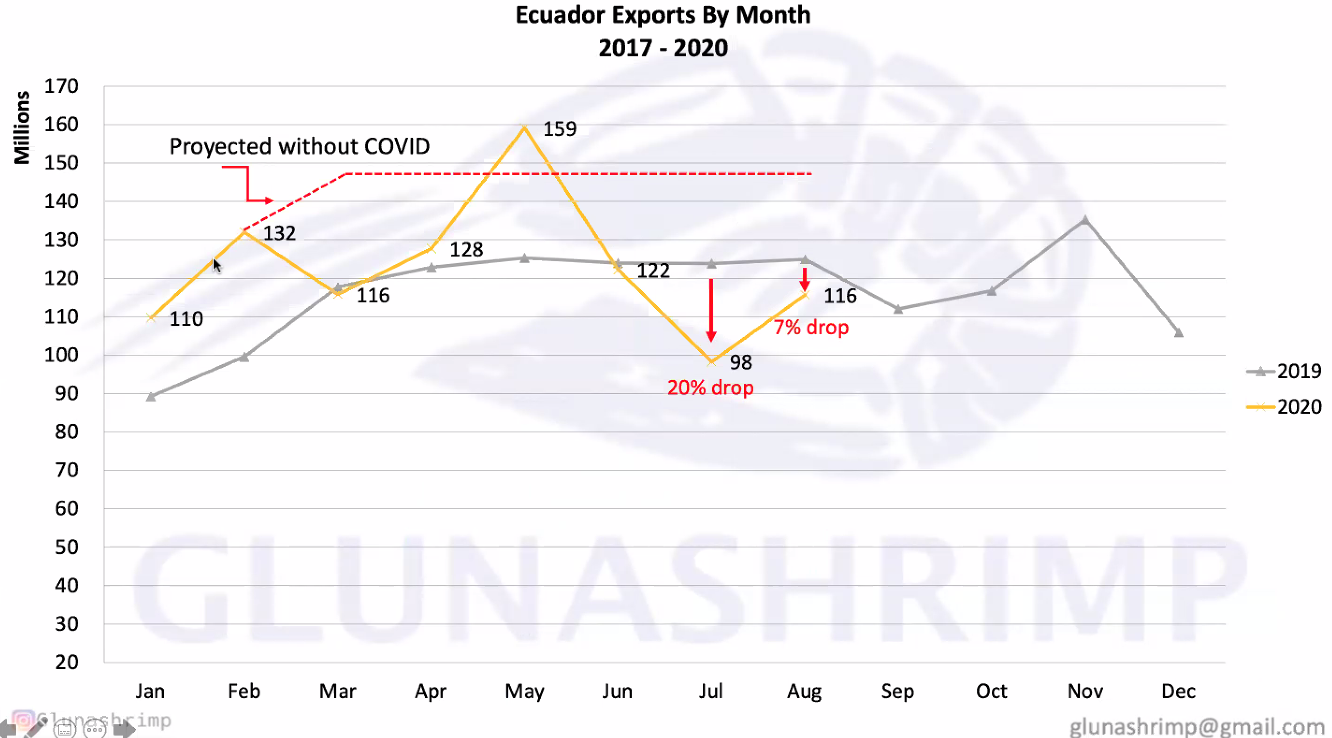

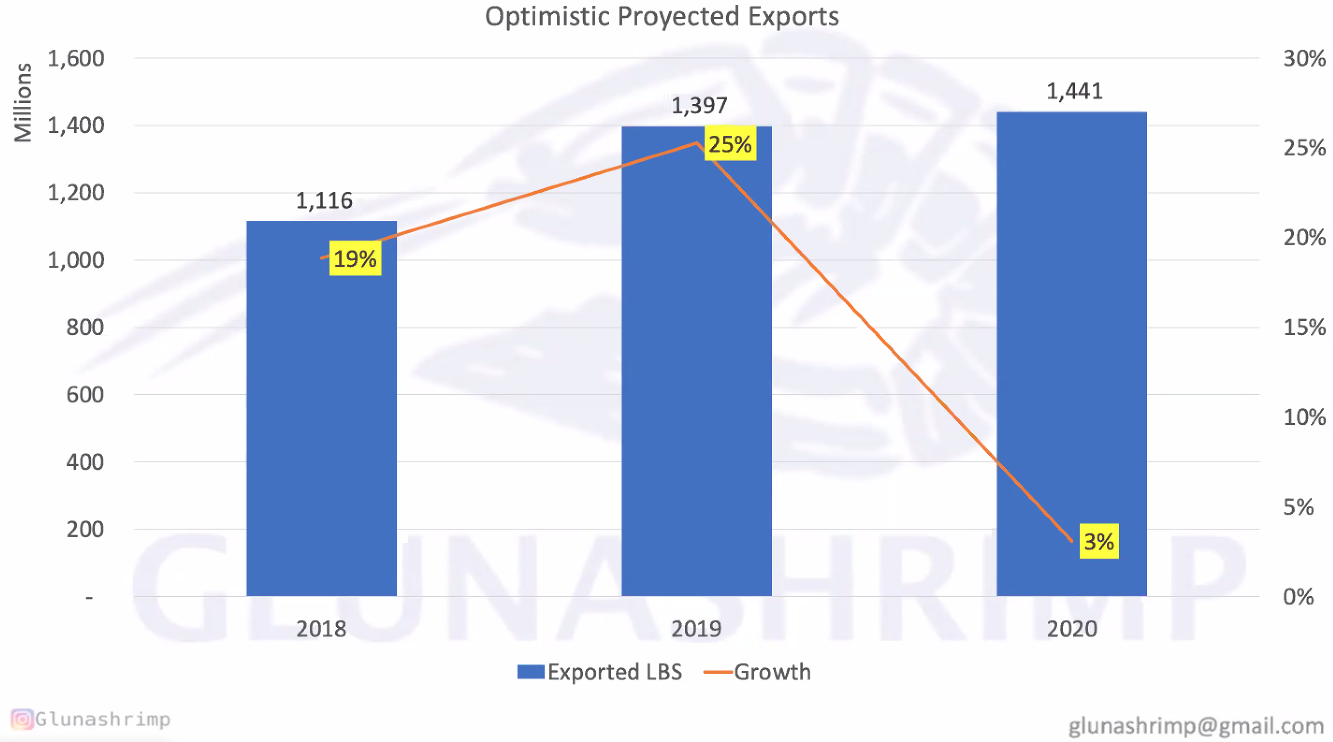

Although Ecuadorian shrimp exports grew 6% year-on-year to 981m pounds between January and August, the reality is that the Latin American country was on its way to increasing its exports by 25% this year, as it did in 2019, according to Luna.

"Even though exports are still up by 6% y-o-y, this is mainly because Ecuador carried a lot of overproduction or produced a lot of extra volume of shrimp during the first two to three months of 2020, which is still decreasing as the months go," he said.

Also, forecasts for 2020 — if the pandemic had not taken place — were that exports would have been stable from May to September and would have dropped between 5% to 10% from then on due to the start of the cold season in Ecuador, Luna explained.

"Not a big drop compared to what it actually happened," he said. "We would have prepared to export in November and December, arranging our protocols in advance to prepare enough stock for the Chinese New Year."

However, if everything continues as it is right now, Ecuador will end 2020 with between 0% and 3% increase in shrimp exports only, he said.

News source: Undercurrent News